Global Remittance Transfers – A Substantial and Growing Market

The global remittance market is big business. The World Bank recently estimated the global value of money remittances will likely amount to $840 billion in 2023, with around $656 billion of that money being sent by workers living abroad back to families in low and middle-income countries and looks likely to exceed $1 trillion by 2030. This financial segment has attracted many large and well-known corporates, not least the likes of PayPal, MoneyGram and Western Union; companies that still complete the greatest number of remittance transactions.

For decades, the likes of Western Union and MoneyGram, with large, physical networks were in the enviable position of being able to charge fees of up to 20% of transfer values in certain regions. Historically, those substantial fees were most often charged to captive audiences who had no access to alternative services. Until very recently, customers in Sub-Saharan Africa for example might still be charged fees as high as 15%. The average fees charged globally have come down considerably, with the World Bank reporting a more recent global average of around 6%.

This sector had been an attractive and highly lucrative market for a few market leaders with a substantial brick-and-mortar asset base and reliant upon large workforces. Before 2000, Western Union, MoneyGram and Euronet Worldwide, between them, were regularly accounting for 20-25% of a $45 to $50 billion-plus annual revenue opportunity. However, in recent years, the digital remittances market has seen the entry of many digital-first “money transfer organisations” (MTOs).

Enter a Bit of Digital Disruption

PayPal entered the money transfer market in 1998 and rapidly enabled online, cross-border money transfers at much lower cost than the brick-and-mortar incumbents, at least within the jurisdictions where they were first able to operate. PayPal was closely followed by Xoom, a San Francisco-based digital money transfer technology company that publicly listed in 2013, before being acquired by PayPal a couple of years later for $890 million.

Much as young challenger banks have eroded traditional high street banking offerings, hundreds of digital start-ups have entered the money transfer market to offer less expensive and more convenient services than those provided by the likes of Western Union and MoneyGram.

There is a wealth of such start-ups across the globe. One site for angel investors lists over 200 such disruptive businesses and London is home to a disproportionate number. A recent count numbers over 20 such digital-first businesses providing some sort of money transfer offering in the capital alone. Companies like WorldRemit, founded by its Somali-born CEO, Ismail Ahmed in 2009 is already beyond “start-up” and posting significant revenue and profits. Like WorldRemit, Azimo, which was founded in 2012 and permits customers using mobile phones, tablets and computers to transfer funds in over 80 countries, also attracted substantial venture capital funding; almost $90 million from investors including Greycroft Partners, Frog Capital, and e.Ventures, for example. Azimo was acquired by Papaya Global in March 2021, for a valuation estimated at $150 to $200 million, representing a valuable exit for those investors.

One London-based example stands out as a disruptive success story. Wise was founded in 2010, as TransferWise, by two Estonian entrepreneurs and attracted early backers like Andreessen Horowitz, Index Ventures, IA Ventures and Richard Branson. Their drive to create TransferWise, was born out their own frustration at the charges they had to pay brick-and-mortar offerings to transfer money between the UK and Estonia. By May 2019, the company was valued at over £3 billion following fresh investment from Vitruvian Partners, Lead Edge and Lone Pine. Trading as Wise, the company reported revenues of over £846 million to March 2023 and over £157 million pre-tax profit. The company listed on the London Stock Exchange in July 2021, with a market capitalisation of around £8 billion. That valuation is currently down around 19% from that initial investor exuberance but that is common to many stocks in what has been a turbulent time for UK capital markets and businesses.

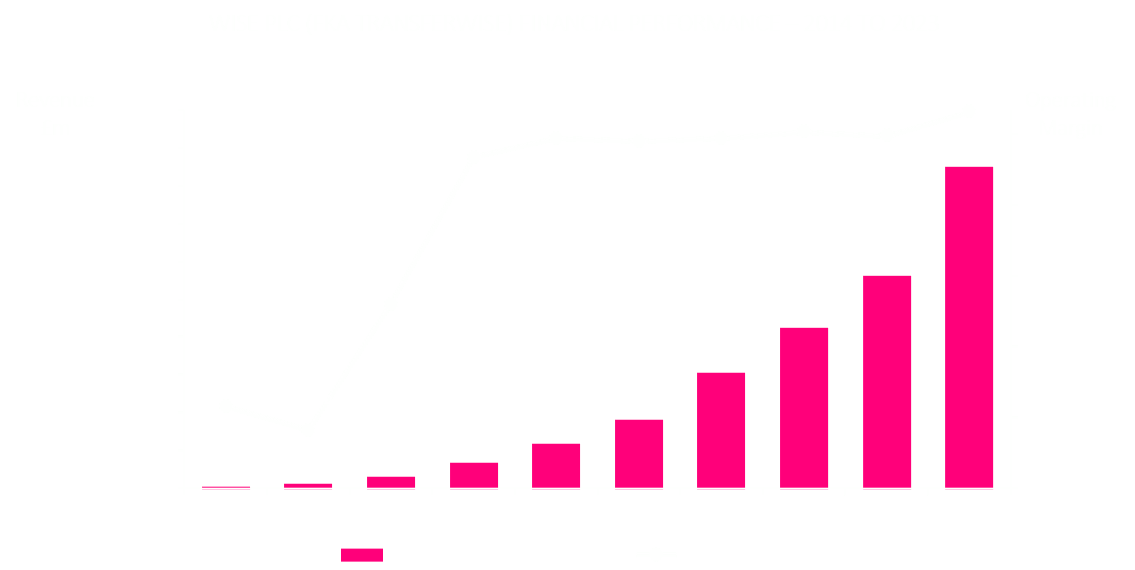

The chart below illustrates what can be achieved with a digital-first approach. From start-up to IPO in just over a decade, this performance is great for the founders, investors and those consumers otherwise facing high fees for sending money home to families.

Western Union’s Long-Term Digital Transformation

A consequence of this digital disruption is that established MTOs have responded by rapidly introducing their own digital initiatives and have converted almost a third of their remittances revenue stream to digital. The Covid-19 pandemic contributed to the acceleration to digital over the last two-and-a-half years.

At the other end of the MTO spectrum is Western Union, still the most recognisable brand providing solutions to overseas workers and still the MTO with the largest market share. Extraordinarily it has been around since before the American Civil War, when its asset base comprised of electric cables and telegraph poles. Today, it offers money transfer services, which are available in over 200 countries and territories, through over 500,000 brick-and-mortar retail agents, combined with WU.com, the company’s digital offering.

Western Union still manages to secure the largest share of that considerable global remittances market. The company estimated it captured about 12% of all such money transfers in 2019. But it has not been easy for the company to maintain such a significant share of what has become a highly competitive market and its share at the end of 2022 was likely closer to 10%. Back in 2009, Western Union’s share of the global money transfer market was closer to 15%.

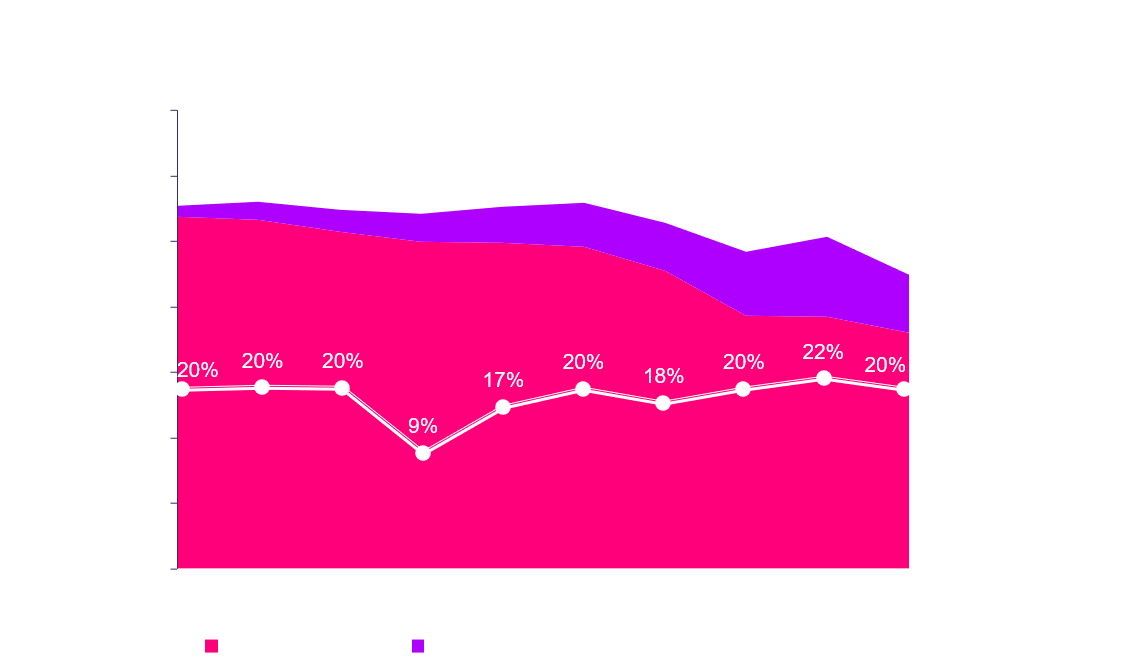

Despite a long history of, and retained networks of brick-and-mortar agency operations, the company also possesses an impressive history of adaptation and innovation. As far back as 1871, the company launched the first electronic fund transfers payment method, to become known as “wiring”. More recently, the entry of digital-first MTO players prompted the company to form Western Union Ventures in 2011 to help accelerate its embryonic online, pre-paid and mobile services. As the chart below illustrates, the growth of digital remittance services has grown from just $167 million in 2013 to over $980 million in 2022; an average annual growth rate of some 19%. That growth rate does not compare to the likes of Wise and many other new entrants but the scale of change at Western Union means that digital remittances comprised 22% of total revenue for the company in 2022. Back in 2013, it contributed just 3% to revenue.

Though very much a legacy operator still, the scale of change this represents for Western Union really should be appreciated for a business that boasts over half a million brick-and-mortar retail agents and around 8,900 employees. In 2016, the company commenced an extensive digital transformation programme for which it emphasised the need for cultural, as well as process, change that required the migration of a primarily on-premises model to a cloud-based infrastructure in order for the company to scale and realise operational efficiencies.

Today, Western Union’s Chief Marketing Officer leads a team of over 400 dedicated to product management and customer experience, as well as broader marketing activities.

As the exhibit below indicates, Western Union hasn’t yet managed to scale. In fact, given various market and strategic complexities, such as suspending operations in Russia and Belarus, revenues declined by almost 12% in the last financial year. But what is a testament to the company’s technical transformation programme and improved agility is the improved efficiency and profit margin significantly powered by its refreshed approach to digital. The company posted an operating profit of over $885 million in 2022. Apart from 2021, that’s the highest level it has recorded since 2012.

There is Still Time to Take Advantage of the Digital Opportunity

The revenue generated by Wise Plc represents approximately 1.7% of a $50 billion-plus annual pool of remittance transaction fees. But as we’ve described, small and unprofitable though many remain, digital-first MTOs have been gradually eroding Western Union’s leading market share.

Disruptors like Wise, WorldRemit and Azimo are fully digital and are breaking the old model of physical, over-the-counter transfer agents. Some are enabling money transfers via mobile applications alone, which is a real benefit to those many customers who may not even have a bank account. The fee structures are ground-breaking; sometimes as low as 1% or even €1 per transaction. This is why such businesses are rapidly gaining market share and their simple models appear to be attracting a grateful customer base.

Just as the founders of Wise recognised a disruptive opportunity and successfully established a customer base of more than 10 million accounts, so too does the sector represent an ongoing opportunity. Western Union boasts a universe of over 150 million customers, so it might seem they have the luxury to change slowly and rely on the majority of customers that still rely upon Western Union’s over-the-counter money agencies. It might have appeared like a proverbial super-tanker, struggling to change course, but the brief review above describes how management recognised the existential threat to their business model and how they successfully introduced and instilled a digital culture within the firm.

We think this is a great story of adaptation, where a large, significantly analogue business has successfully mapped out and implemented a strategy that has digitally enabled a necessarily reduced workforce, but at the same time continues to serve a large, and still unconnected, customer base. According to the UN’s The International Telecommunication Union, there were still over 2.9 billion people globally in 2021 that were still not connected to the Internet. With a large number of that part of the population working abroad to better provide for families back home, Western Union remains in a good position to serve foreign workers sending money back home, both those that remain unconnected as well as those that become connected.

The World Bank estimates that over 80% of global remittances remain conducted through traditional payment corridors, like those still offered by Western Union and MoneyGram. There are also at least 1.5 billion unbanked persons across the globe, many of whom are far more likely to already have, or obtain access to, a mobile phone rather than open a bank account. Those numbers represent a massive future opportunity to both incumbents and disruptors alike. It’s safe to say there will be further adaptations and further digital innovations to assist both camps in their attempts to capture that emerging audience.

This anecdotal article describes some of the opportunities realised and some yet to be uncovered in just one sector. Similar opportunities can be secured in most sectors, whether that involves customer-facing Customer Relationship or E-Commerce implementations or more fundamental Enterprise Resource Planning improvements. If your business is experiencing any of the challenges similar to those once faced by Western Union, or you find your attempts to digitally transform are not progressing as well you hoped they might, then please do get in contact.

Panamoure is sector and technology-agnostic and we would welcome the opportunity to share some of our insights from working with clients that have experienced just such challenges, and have benefitted from our technology experience and practical advice.