Whilst we won’t deny not every project is right for offshoring, we do want to highlight that for the right projects, offshoring can significantly lower your IT costs. In fact, we’d go a step further and suggest a successful offshoring model can have a significantly positive impact on your business’ overall performance and profit margin.

Critical to delivering offshore value is making sure you have the right mix of skills in the right offshore location. If an offshore model is appropriate, it’s important to create and foster collaborative, bespoke teams both on and offshore. During this time it’s important to review your team make up and ensure the right person is in the right location for each project task – this might mean relocating some onshore team to offshore in the short-term and vice versa.

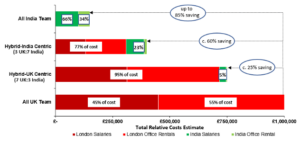

By identifying what roles should be fulfilled and where, we are typically able to deliver complex transformational change using a very lean mix of onshore and offshore project resources, often hitting a ratio as high as 20:80 respectively. The cost savings that this brings are typically up to 60% for project delivery and usually about 50% for ongoing managed services. Here are some estimates to illustrate the potential cost savings with respect to team members and office occupancy based in India, compared to the UK.

Illustrative Potential Cost Savings with IT Services Offshoring to India

Sources: Payscale.com, Glassdoor, Savills, Oktra, Panamoure insights

Note: based on 10-person team, comprising 1 Project Manager, 2 Senior Developers / Leads, 4 Developers and 3 Test/QA professionals or equivalents. Project Manager is based in UK or India for UK Centric and India Centric teams, respectively

This assumes a ten-person team (for example delivering IT managed services or application development) and the equivalent costs for base salaries and office occupancy in London or all based in Bengaluru (Bangalore). It shows the relative cost of providing that service entirely from India could theoretically be 85% less expensive than having the team all based in the UK. We typically employ a hybrid model, where the savings are between 40 and 80% very much depending on the ratio split of where respective team members are located. The figures are based on average salaries and grade B offices in London and Bengaluru. Obviously, there will be huge variation outside of these averages within said locations, so the real cost savings will be somewhere between the two and given the very fluid market dynamics observed, in the UK in particular, it’s currently really impossible to measure with any great certainty. Don’t forget, there will also be other associated costs such as utilities and additional remuneration that would need to be factored in.

We hope we have shown how an offshore service can be financially rewarding but reducing costs is often perceived as a one-time exercise with finite benefits. Setting up an offshore team delivers greater benefits overall, such as greater technical ability that is both available and affordable. Adopting a more holistic approach will ultimately help increase revenue, encourage scalability and realise owners’ and investors’ growth plans.

It is also worth noting that Panamoure has its own Learning Management System (LMS), which equips our offshore teams with key business subject matter expertise. From our experience, this allows us to break the conventional team norm and utilise offshore resources for what would normally be considered typical onshore tasks.

One final point, you should consider you get the right knowledge transfer mechanism in place and this is where looking at relocating key personnel for at least the short term. This ensures maximise knowledge transfer between both teams and promotes a positive working relationship.