Sweating the portfolio harder: Cost-Out activity that pays for Itself

With M&A activity down and exits at their lowest point in over a decade, there is an ever pressing need to maximise the value of existing portfolios.

What’s the context?

- Decline in PE activity and exits: M&A activity has dropped, with exits falling 66% from their 2021 peak. High interest rates have increased refinancing costs, making exits more protracted and challenging for buyout funds amid uncertain valuations.

- Learning from the Past – Operational Improvements: Experienced private equity professionals have successfully navigated multiple crises by concentrating on operational improvements in their portfolio companies. For example, during the Global Financial Crisis, Bain Capital focused on enhancing salesforce efficiency, cost management, supply chain optimisation, working capital improvements, and talent development to protect and improve their existing portfolio.

Cost-Out Through Smart Automation

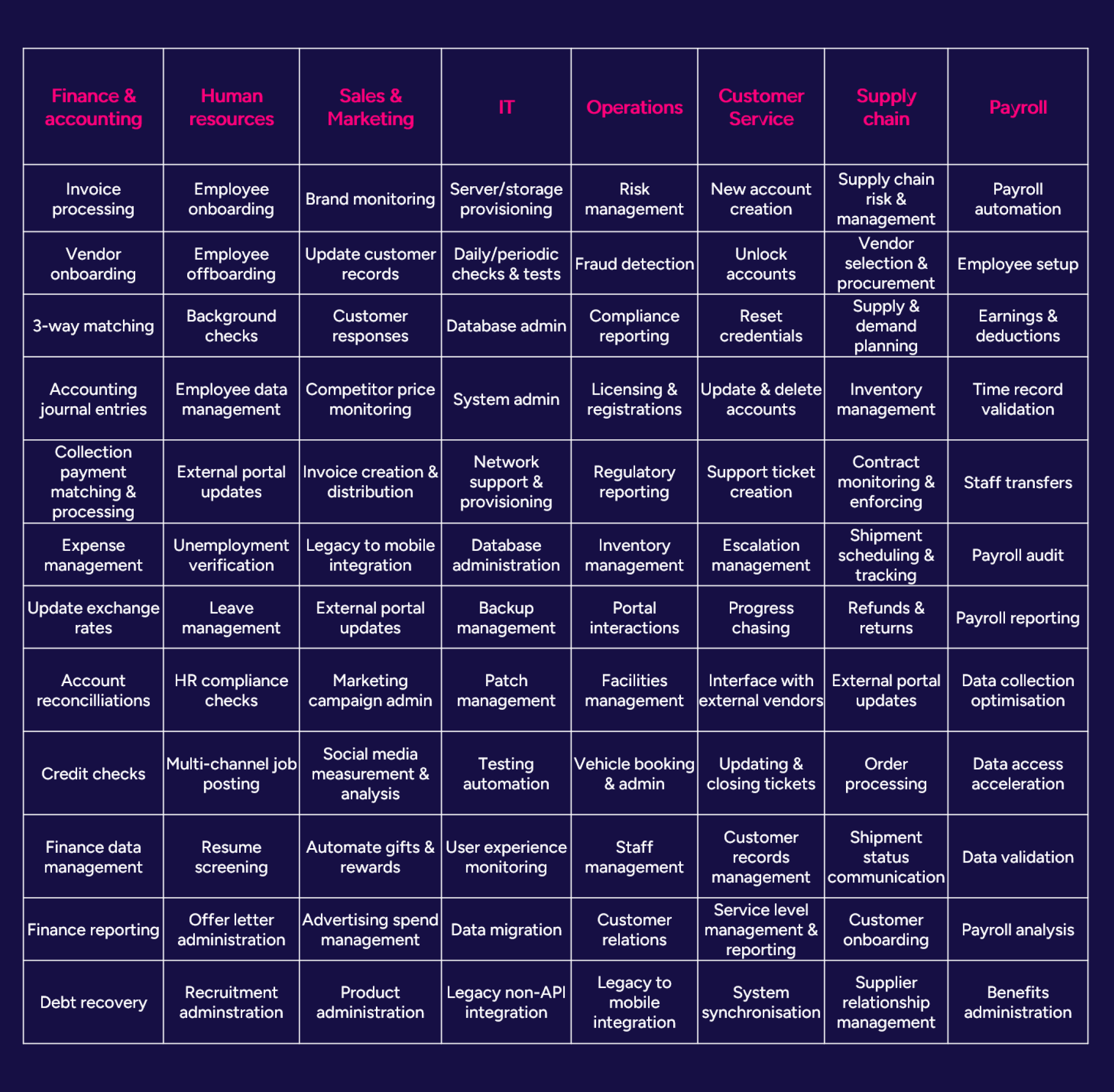

In the current climate, digital approaches, particularly smart automation, are proving invaluable in achieving cost-out initiatives. Everyday Technologies like RPA (Robotic Process Automation) and OCR (Optical Character Recognition) when combined with simple AI/ML can streamline business processes and automate repetitive tasks. This reduces human error, ensures consistency, and accelerates task completion times. RPA can be deployed across various departments, including Finance, HR, and IT, significantly enhancing overall productivity.

Identifying Opportunities for Smart Automation

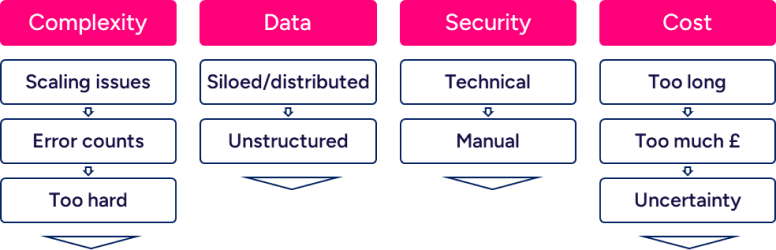

There are several indicators that a company might benefit from smart automation:

Typical Use Cases for Automation

Common areas where smart automation can deliver substantial benefits include:

Additional Digital Levers to Maximise Portfolio Value

In addition to automation, there are several other digital strategies that PE firms can employ to maximise portfolio value:

01 Healthcheck

A light-touch, low-cost IT Healthcheck mirrors the outputs of more formal Digital Due Diligence but with a smaller scope. This exercise enables company managers and their advisors to shape and share a deliverable digital strategy during the current downturn, preparing the company for enhanced growth once the market turns bullish again. This relatively low-cost, high-value exercise can be rapidly executed across the main operating company, subsidiaries, and other business functions.

02 IT Cost Optimisation

Guiding company management through various IT dimensions helps form a comprehensive view of how their IT spend compares within the industry. This includes evaluating current investment plans, strategic goals, operational maturity, and external factors. The result is a pragmatic IT optimisation plan that identifies where redundant and legacy applications can be removed or rationalised, where better value alternatives exist, and other low-hanging cost-saving opportunities. Such exercises can have an immediate positive impact on EBITDA.

03 Supply Chain Efficiency

As part of IT Cost Optimisation, many companies have yet to unlock the full potential of a digital approach to supply chain management. Modern supply chains are extensive and complex. Historically, fit-for-purpose technologies capable of operating across disparate suppliers were unavailable, but things have significantly improved. Companies can now achieve greater transparency across the supply chain, reducing costs and monitoring sustainability metrics effectively.

04 ERP Considerations

Evaluating the need for updated Enterprise Resource Planning (ERP) systems is crucial for overall operating efficiency and productivity improvements. Many companies rely on outdated or over customised ERP platforms, which are often either expensive to support or no longer supported at all. Implementing a suitable ERP system can improve corporate efficiency, increase revenue, and deliver a rapid return on investment if executed well.

05 Customer Relationship Marketing

While most companies have some form of digital marketing capability, this rapidly changing area of software development offers increasingly sophisticated tools. Companies often operate multiple CRMs within different business units. Modern CRM strategies go beyond capturing new customers and driving additional revenue; they focus on full customer experience, retaining engagement and loyalty, and exploring cross-selling opportunities.

06 Integration

Despite the recent decline in overall investment activity, many companies continue to pursue active buy-and-build strategies. Properly integrating subsidiaries or recently acquired companies can yield significant synergies. Research by McKinsey & Co. suggests that over half the synergies from M&A transactions depend on successful IT integration. A structured framework for add-on investments can facilitate rapid and efficient integration with the parent company.

07 Integration

Accurate and well-managed data is a valuable resource that can identify cross-selling opportunities, new revenue streams, and assist with customer retention. Ensuring data is clean, structured, and efficiently stored allows for better business insights and decision-making. Connecting data points within an organisation removes silos, providing consistent information necessary for effective role execution.

08 Security

With the abundance of data comes increased responsibility. Recent benchmarking studies indicate that budgets allocated to cybersecurity and data compliance are growing faster than any other part of IT spend. Cybersecurity risk management exercises are essential for identifying and evaluating weaknesses, establishing comprehensive strategies to mitigate risks, and ensuring organisational protection.

09 Talent Engagement

For companies without a scaled IT team, leveraging external expertise for complex digital improvements presents an opportunity. This can enhance employees’ skills to manage upgraded IT infrastructure and extend their engagement. Introducing appropriate digital infrastructure may also facilitate recruiting new skills, capitalising on employees’ past experiences, and engaging with external experts to improve the IT skillsets of the current workforce.

10 Managed Services

In times of rising costs, partnering with a Managed Service Provider can implement discrete projects or manage day-to-day IT services at a reduced cost. An Offshore Delivery Service offers flexible, low-risk solutions for daily managed services, bespoke software development, software implementation, and BI solutions. Well-structured hybrid offshore-onshore models also promote talent engagement by sharing technical skills and creative solutions to IT challenges.

The Holy Grail – Self-Funding Value Creation Projects

By prioritising elements that deliver the quickest ROI, subsequent projects can be partially or fully funded by the savings generated. Panamoure has successfully delivered entire roadmaps of low-cost, high-ROI projects that essentially pay for themselves quickly.

In scenarios where employee digital maturity is relatively low or there is resistance to change, starting with a use case that quickly eliminates a high-volume, simple manual task can win hearts and minds. This approach empowers staff to work closely with IT and embrace Smart Automation, fostering a collaborative environment that supports further digital transformation efforts.

Additional Benefits of Smart Automation :

- Time Savings: Speeding up processes and reducing manual intervention

- Focus on Value-Add Activities: Freeing up teams to work on strategic tasks

- Higher Productivity:Enhancing overall efficiency and output

- Error Minimisation: Reducing the likelihood of human errors

- Better Standardisation: Ensuring consistent process execution

- Increased Auditable Trail: Providing clear and traceable records

- Improved Compliance: Ensuring adherence to regulatory requirements

- Superior Customer Experience: Enhancing service delivery and satisfaction

- Improved Scalability: Enabling processes to scale seamlessly with growth

Rapid Cost-Out and Reduced Risk of Failure

Panamoure can deliver most automation projects in as little as 4-8 weeks, making it a quick and efficient solution. Our approach involves short, sharp, successive automation projects, achieving a digital evolution without the risks associated with large transformation projects. For example, ten projects costing £30-50k each can be completed rapidly, providing early ROI and reducing the overall risk of failure compared to a single, large-scale £300-500k transformation project.

Getting It Right The First Time

For any value lever, its crucial to get it right the first time to avoid unnecessary costs and delays. If your portfolio companies lack the necessary infrastructure or are struggling with stalled projects, now is the time for PE sponsors to address these gaps. Enhancing digital capabilities and utilising skilled offshore services can make a significant difference.

All businesses need to become digital by default, and smart automation is a great place to start this journey. Download our ‘Sweating the portfolio harder’ PDF here.