“I don’t want to describe luxury as recession proof – it feels like tempting fate – but it is an extremely resilient sector, both at the top end of the market and at the affordable luxury segment.” – Helen Brocklebank, Chief Executive of Walpole That quote from the head of the UK luxury sector’s representative body comes from a Guardian article written by James Tapper and Alice Fisher towards the end of 2022. The authors and Helen Brocklebank make some very good points about the sector, which has exhibited a certain resilience and remarkable recovery post COVID-19 lockdowns. But Ms. Brockbank’s reticence to describe the sector as ‘recession proof’ is spot on.

Long-term resilience and digital growth in global luxury

Earlier this year, global management consultancy, Bain & Co presented a report estimating the global luxury goods market to be worth over $380 billion and that it had grown some 22% in 2022. That was on the back of 32% market growth in 2021, highlighting a greater resilience compared to the sector’s last period of decline during the Global Financial Crisis. Back then, the global market was less than half the value reported for 2022 and, apart from two years of decline following each of those crises, the sector has delivered a 6% compound annual growth since 2008. Bain estimates the market to grow 5-7% a year and is likely to be worth over $550 billion by 2030.

Although based on fewer categories of ‘luxury’, Statista estimates the UK market will be worth over $16 billion in 2023 and that over 30% of luxury goods sales will be completed through online channels. In spite of some of the unique challenges faced by businesses operating in the UK, the luxury market here has demonstrated similarly resilient and innovative characteristics. During the pandemic, while in-store sales declined by 36%, online sales of luxury goods increased by 22%, for example. Some enterprising luxury retail businesses did very well during this period and continue to do so. For example, UK luxury fashion brand Mulberry reported a 69% increase in online sales during the pandemic, with E-Commerce sales accounting for 37% of total revenue.

Mulberry is by no means the only UK success story in the luxury brands space. Burberry has done a remarkable job of capturing both the international and digital opportunity since it became publicly-listed in 2002. We’ll refer to them throughout, by way of example. Back in 2012, less than 5% of Burberry’s revenue was conducted through digital channels and 25% of revenue was generated in the UK. Last year, less than 8% of revenue came from UK-based customers and online purchases comprised over 22% of group revenue.

The reality of providing luxury goods in a UK post-lockdown ‘new normal’

With the rebound in sales, growing number of operators and customers with sufficient capital to consider purchases within the broadening definition of what is ‘luxury’, and the opportunity to do so digitally, the famed resilience of the luxury goods sector is certainly evident. As Ms. Brocklebank hinted, some might suggest the sector is ‘recession proof’, but no single company can make that claim and prove impervious to all the systemic and non-systemic risks lying in wait out there.

For many retailers of aspirational goods, the extended lockdowns caused by the COVD-19 pandemic created a very difficult period. It certainly wasn’t without its challenges, with global retail sales dropping 22% in 2020. Enforced outlet closures, restrictions on conducting face-to-face business-as-usual, with new or consistently loyal existing customers, proved all but impossible, forcing many providers of luxury items to rush to digital means of sales and engagement for the first time.

For some, that rush to interact with customers through digital has worked well, opened up new revenue streams and delivered welcome changes for customers to experience. For some businesses, it did not provide the solutions for which they had hoped. Others chose to not explore that opportunity at all, resolutely sticking with the sector’s historic reluctance to consider a digital approach.

Just as no company can be fully recession-proof, so too it’s the case that the adoption of digital infrastructure and practices alone will not necessarily provide the route to long-term survival and growth in what is an increasingly competitive arena. Luxury shoe brand Steptronic fell into administration in March 2022, for example and the Chinese owner of Gieves & Hawkes, the famous Saville Row tailor, failed to find a buyer for its luxury brand until administrators sold it to Mike Ashley’s Fraser Group in November. An even more recent example, upmarket jewellery retailer, Vashi, closed its doors in April this year unable to raise new funding. The products of these closing or struggling brands are often wonderful, the quality superb but that in itself is rarely sufficient to ensure long-term success in a rapidly changing luxury goods environment.

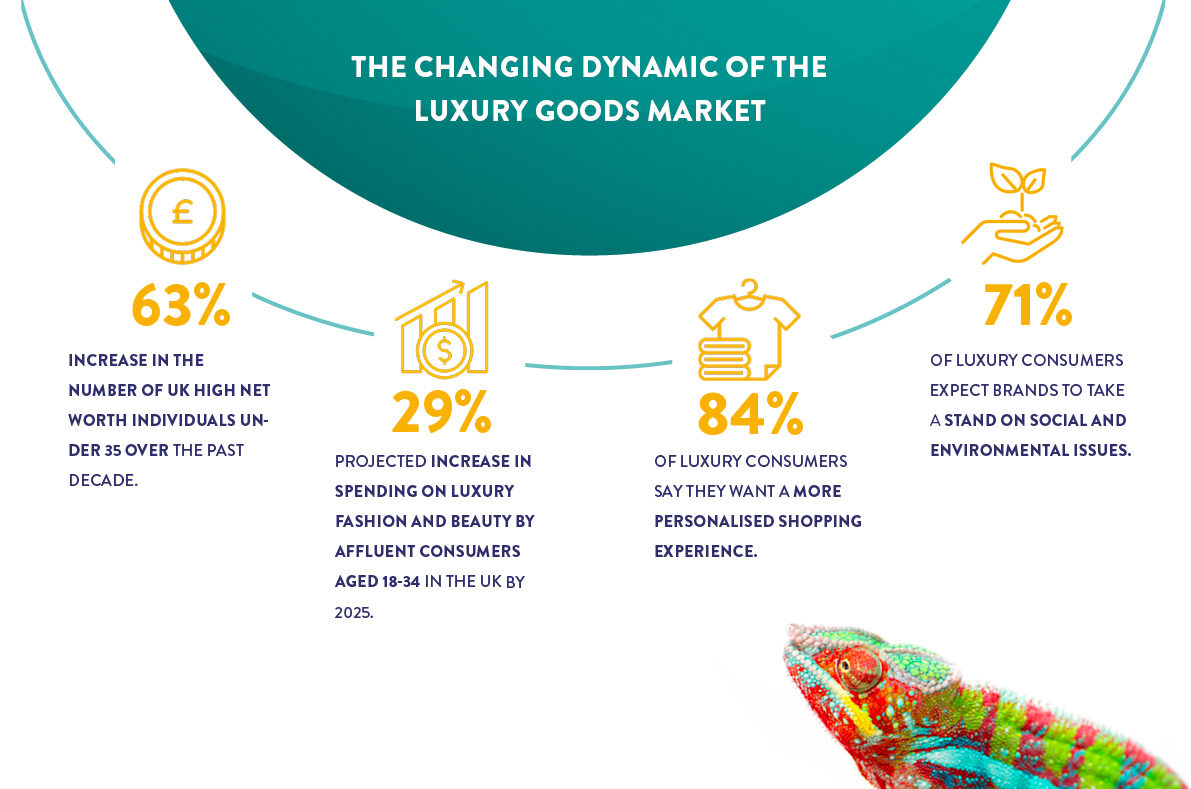

Changing consumer demographics and the readiness to embrace digital personalisation

One estimate put the growth in global online sales of personal luxury goods at 20% in 2022 to reach an estimated $82 billion. It also anticipates the market for luxury goods purchases through online channels will amount to over $136 billion by 2025. The growth in online retail is significantly driven by Millennials and Gen Z shoppers’ growing desire for luxury items and their readiness, and for many their preference to make those purchases through online channels, whether for new products or from the online secondary market that is growing even faster than retailers’ primary E-Commerce sites. Millennials and Gen Z consumers now account for 38% of the luxury goods market in the UK, for example. Following lockdowns and travel restrictions, other groups also gravitated to digital alternatives to in-store purchasing, so that today, if you are in the business of selling luxury items and don’t have an E-Commerce function, this would be considered unusual.

That already referenced doyen of the UK luxury market, Burberry, is a case in point. Having first sold online in 2006, the company has fully embraced digital technology and innovation to “supercharge digital sales”, but also to further elevate the brand and improve the customer experience onsite at over 400 directly operated stores. Today, the company employs applications that includes; live chat, virtual appointments and client events, artificial intelligence, augmented reality, big data, social media and other applications to improve operational efficiency and customer experience. That current efficiency has helped the company generate over £2.8 billion revenue, an operating margin of 19% in its last financial year and will help it achieve its medium-term goal of £4 billion revenue.

What Burberry has done particularly well is ensure a personalised experience for both in-store and online customers, as well as maintaining the brands rarity value. Its “B Series” limited release collections, for example, are only available for 24-hours through social media. That personal touch was so much easier when all luxury purchases were conducted face-to-face. That world has massively changed. Today, data analytics, machine learning and AI applications can help determine customers’ behaviours and preferences enabling retailers to target the right brand communications with the right recipients.

That success is in stark contrast to another long-suffering luxury brand. Aquascutum, which had administrators appointed, for the second time in September 2020, had already been acquired out of its first administration in 2012 by the same China-based owner of previously mentioned Gieves & Hawkes. The reasons for the company’s demise are many, but a slow move to digitise, failure to capitalise on data and analytics, to appropriately price goods and poor customer engagement are all referenced in the trade press as contributing factors.

It’s not just about digital and personalisation. It’s about sustainability and Business Change!

As a technology and change consultancy, Panamoure is a natural advocate of technology and digital solutions to help luxury brands and other businesses achieve their full potential. But where we can really make Clients excel is when they fully embrace Change. When we work with Clients, unless the engagement is for a simple and straightforward implementation, we nearly always advocate a holistic exercise of Discovery.

Fully understanding what a Client has in place, what works and what is obstructing the business, is key to further understanding what needs changing and introducing to make the business as efficient and value creating as possible. This does not just refer to the digital transformation but to the change required, across people, business units, operations and your IT Services as a whole, so that they work together seamlessly to deliver better insights, more efficient operations and a widening arena of sales opportunities.

One essential part of all companies’ necessity to Change, is the growing imperative to carry out business more sustainably. We’ve previously written about how best practice Environmental, Social and Governance practices not only tick the necessary boxes for potential investors, but does actually make for better business. As a business owner, you may not care about sustainability issues (although you really should) but the majority of your customers will. 67% of consumers consider sustainability to be important when making a luxury purchase and the UK luxury market for sustainable goods is projected to grow by 9% annually, reaching £12.5 billion by 2025. Luxury fashion brand Stella McCartney reported a 27% increase in revenue in 2020, partly due to a well-communicated focus on sustainable and ethical practices, for example. The advantages are not restricted to sustainability for environments but also for your business. As well as reducing potential risk, their application can lead to new revenue streams, help attract new and retain existing customers. This latter point is becoming increasingly important to younger consumers looking to purchase luxury items.

For many of those retailers of luxury goods that took those first steps into digital or enhance what they already had in place during pandemic lockdowns, it really has been a time of opportunity. But, as with many other industry sectors, the corporate universe presents a panorama of companies that have succeeded in realising such an opportunity and, of course, many that have not. We don’t pretend that a transformative digital strategy will always be the perfect solution to growth and continuity, but we do believe that a well-executed digital approach, combined with a transformative strategy across the business offers the best prospect for luxury brands to continue as a going concern in this challenging market. If combined with the right overall business strategy, it will also help deliver ambitious growth plans.

Getting robust for the future opportunity

The anticipated growth presented by organisations like Bain & Co, Statista and others clearly demonstrate luxury goods’ abiding and broadening market appeal. But it’s also an increasingly competitive arena with many new entrants combating for purchasers’ pounds, dollars and increasingly, yuan. If your business manufactures and distributes such brands, you want to thrive and not just survive. To do that you will need to leverage both internal and external data to offer more personalised content and experiences. But, as we’ve explained, that’s just the simplest way to grow your business. Panamoure has helped a number of aspirational brands businesses to implement the practical and cost-effective steps to enable them to make better use of their data to eliminate costs, drive increased revenue opportunities and capitalise on efficiencies and automation of processes across the business as a whole.

If that reads like a sensible approach, then do get in touch for a no-commitment discussion to see how we can help you with your business priorities as well as talk about how we have been able to help similar businesses.