The Apparel Sector’s Ongoing Challenges…

The UK apparel market and its customers were as shocked by the changes forced upon it by the pandemic as were retailers and their customers in other consumer sub-sectors. The fortitude and innovation exhibited by apparel retail and manufacturers, and their respective consumers is nothing short of impressive. As a whole, those groups have adapted to changing technology to rapidly execute revised strategies that serve and sell to consumers with similarly revised aspirations. Yet, as we itemised in our opening post, challenges persist for all those participants.

The UK apparel market, comprising over 18,000 manufacturers, distributors and retailers remains highly fragmented and made up of mostly small and medium sized enterprises. Scaling is often difficult and for brick-and-mortar retailers in particular, the reality of ever more onerous onsite high street costs and the prospect of faltering supplier channels and rising operating costs poses a very real existential threat. 250 companies across those three segments went into insolvency in the first three quarters of 2022, just eight fewer than in the whole of 2021.

The risk remains very real and the sector has an unfortunately long track record of substantial corporate failures which includes famous names like Topshop, Arcadia and Dorothy Perkins. Scale can offer a degree of protection but only if combined with an appropriate strategy. As UK consumers discovered their liking for carrying out their clothing and footwear shopping online, those brick-and-mortar businesses that had failed to invest appropriately become increasingly exposed, with many forced into insolvency or sold at knock-down prices.

…are Counterbalanced by Real Opportunity for Growth

For more established apparel retailers and manufacturers, this constantly changing market dynamic should represent great opportunity. This can be evidenced by the rapid digital transformation by those that successfully took on that strategic challenge during COVID lockdowns, and also for those that realised the opportunity to acquire so many failing retailers at reduced valuations.

The rise of E-Commerce, digital-first business models has also made it easier for newly-formed apparel retailers to enter the market. The retail, manufacturing and distributor sub-sectors combined have produced an average net increase of more than 475 companies each year since 2010. Though the sectors’ rapid adoption of digital practices has made entry into the market even easier, it does not mean that it is an easy sector in which to remain, as the number of insolvencies indicate.

By 2025, it’s anticipated that over half of all apparel sales in the UK will be completed online. At £32 billion that will represent something like 20% of all UK online sales. Many young companies are digital savvy and even digital-first and, although growing numbers of UK apparel retailers now sell electronically, it is still surprising just how many have yet to embrace some form of digital optimisation. Legacy retailers are the businesses that are struggling now because the amount of data and processes they already have makes the prospect of digital transformation appear even more daunting. However, this is really not the case. It will only make the eventual transformation all the more worthwhile.

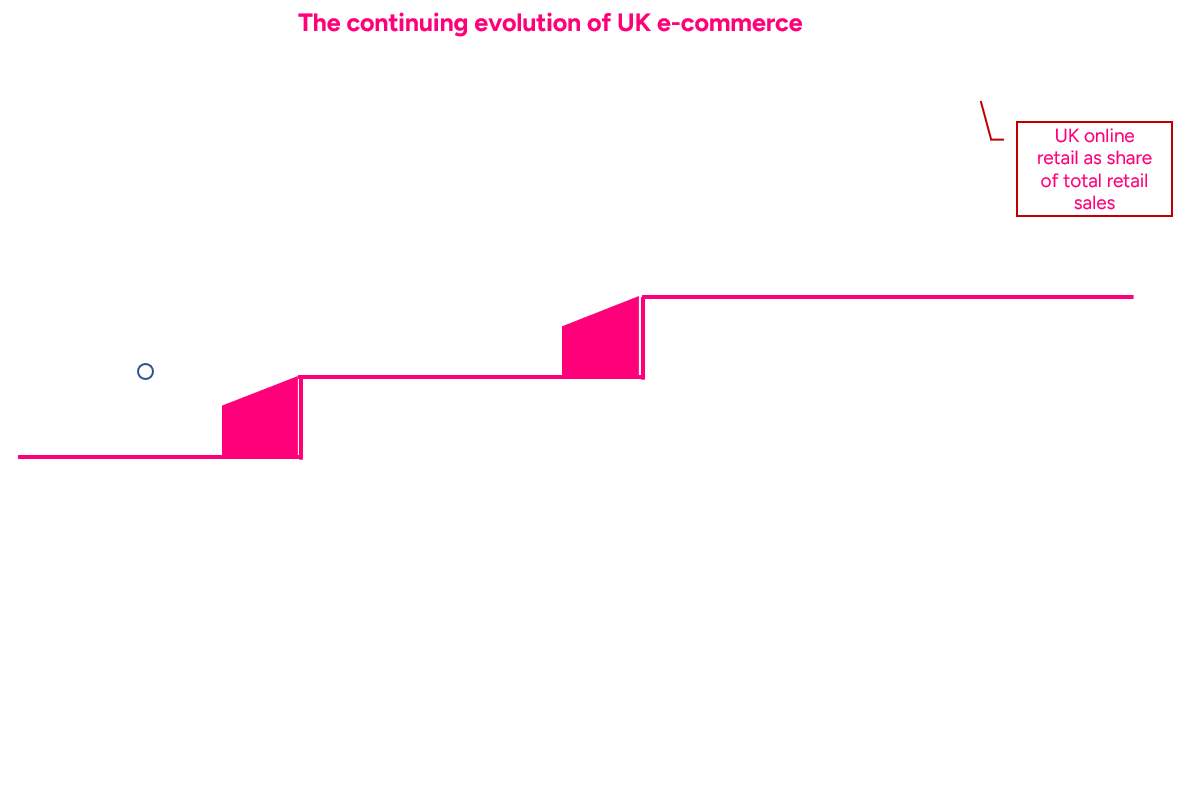

E-Commerce is just one opportunity for apparel retailers, manufacturers and distributors to assess when considering a programme of digital transformation. The rapid growth of E-Commerce across the entire UK retail market provides a momentum to a technologically evolving landscape as businesses compete to satisfy customers’ different and changing demands.

Here we present three “waves” of E-Commerce to illustrate the sector’s modest beginnings and how that compares to the myriad of tools and customer experience facilitators available to e-retailers today. Some commentators describe the transitioning of consumers and retailers into a “fourth wave” combining omni-channel retail and supply chain excellence, something that we have been observing, particularly in the apparel market. This highlights just some of the data-capturing and revenue enhancing options available to retailers today as we transition from the third to that proposed “fourth wave”.

In reality, of course, neither scientific advancement nor E-Commerce innovation proceeds in waves but more of a continuous, incremental advance, with occasional big leaps in development and impact. The first and second waves, however, do serve to remind how far E-Commerce functions, feeding into retailers’ customer relationship management (CRM) tools, have come in recent years.

Omni-channel and supply chain excellence hints at true business transformation and this is that Panamoure encourages for its consumer-facing clients. The growing availability of these data-driven tools increasingly enables business transformation and to provide opportunity for corporate self-reflection and strategic change.

We can implement an E-Commerce infrastructure, an online retail or CRM platform, or restructure your company’s valuable, but siloed and fragmented data. Where the really exciting opportunity lies is in incorporating these components within a broader digital transformation. A digital data transformation will provide a clear oversight of how to enhance and expand the value of retail brands, even those already benefitting from an E-Commerce function. If you are at the stage of commencing or updating your E-Commerce functions, or have been thinking about a more holistic transformative exercise for your company, please do get in touch for a fuller conversation.

Panamoure has helped a number of businesses to implement the practical and cost-effective steps allows them to make better use of their data to either:

- Remove cost

- Drive efficiencies and better automation, and

- Drive increased revenue opportunities

We would welcome a no-commitment discussion with your organisation to see how we can help you with your business priorities as well as talk about how we have been able to help other similar business. If you would like to know more then please reach out to us.